Reliable Insurance Group Blog

|

|

The global pandemic raised awareness of how fragile life is and the importance of preparing for the unexpected. According to LIMRA research, 31% of Americans say they are more likely to buy life insurance as a result of COVID-19. This is even higher across many demographics, including Millennials (44%), Black Americans (38%), and Hispanics (37%).

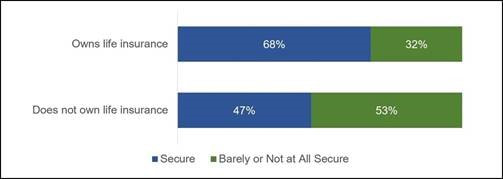

Our research also shows that people who own life insurance are more likely to feel financially secure. Nearly two thirds of insured Americans say they feel financially secure, compared with less than half of those uninsured.

0 Comments

If you rent a home or an apartment, you likely have considered ways to protect the things you own. You may even have purchased a renters insurance policy. Does that mean your renters insurance covers theft? It’s a good question. With millions of home larcenies and burglaries reported in the U.S., victims may be unsure about potential recourse when they are the victim of theft. With a renters insurance policy, you’ll likely be able to recoup some or all of the value of your lost items.

Facts from LIMRA Who Currently Owns Life Insurance?

Lucy Lazarony, Editor Forbes Errors and omissions (E&O) insurance comes to the rescue if you make mistakes in professional services while doing business.

This coverage is also known as professional liability insurance and it will help cover the cost of a client or customer who makes a claim against your business. Errors and omissions insurance assists with legal defense costs, judgments and settlements. Without errors and omissions insurance, you’d have to pay out of your own pocket if a customer says you owe them money because of a mistake. If your business provides a professional service or offers advice to clients, you may be a good candidate for errors and omissions insurance. If my husband and I have life and disability policies through our employers, is that sufficient? Both of us have very high coverage amounts, but neither of us has policies outside of work. If we ever left those jobs, voluntarily or otherwise, we would have to replace our group coverage with personal policies then. Is that a solid strategy?

You got one thing right – I am the type of person who has a strong opinion about group life and group disability insurance. It is also worth noting how great it is that you value life insurance and disability insurance. Many people do not share your prudence. I also like that you’re thinking ahead in regard to how a job change might affect your benefits strategy. I am clearly building you up because you’re about to learn why you need to restructure your entire plan. Group life and group disability benefits are fantastic. They are generally cheap, easily attainable, and wonderful when you have an insurability issue. However, they should not be used in place of policies you can buy outside of the workplace, especially when it comes to life insurance. The latest number I could find from the Bureau of Labor Statistics suggests you, and every other American will hold roughly 11 different jobs in your lifetime. This means you will likely have jobs with good benefits and jobs with bad benefits. And just because your current gig allows you to amass large amounts of life and disability insurance coverage, does not mean your next job will. This is precisely why you should buy your coverage outside of work, and only use group policies to supplement your coverage for cheap. Is it more expensive to do it this way? Yes, but life insurance is about buying the right to transfer risk to another entity. When your entire insurance strategy is predicated on staying at your current job, then you are taking-on additional unnecessary risks. Both life and disability insurance are the cheapest when you are young and healthy. And while some people are able to improve their overall health as they get older, no one has figured out to stop the clock on aging (as far as insurance underwriters are concerned). My big fear for you is that everything goes wonderfully for you for a very long time, and then it doesn’t. At the point it stops going so well, you might be much older and much less healthy. Therefore, coverage might either be prohibitively expensive, or you may not qualify for coverage at all. Please believe me, I am not fearmongering. I have witnessed this awful reality several times over the years. The best way to prevent this from happening to you is to purchase the proper amount of coverage outside of work. With life insurance, your work coverage will be very cheap gravy which would go a long way in providing for your family in the event of your death. Some people choose to purchase permanent coverage as their primary coverage, and then let the group insurance, which is term coverage, fall-off over time. Some people choose term life insurance as their primary coverage for three reasons, which often all happen at the same time. First, it is tremendously less expensive than permanent coverage. Second, you can purchase a lot more of it for the price. It is very important to have the right amount of coverage, as most people have too little. The final reason people choose term is that it is part of their overall financial plan. In this instance, the goal is to build assets and repeatable retirement income, throughout your career, thus creating a layer of self-insurance at retirement. With disability insurance, your personal coverage will actually wrap around your group coverage. If you’re trying to be as comprehensive in your planning as possible, do not ignore the need for supplemental disability insurance. Call your insurance agent and restructure your plan sooner rather than later. You will absolutely spend more money than you’re spending on your current plan, but part of the pain from that comes with having utilized a suboptimal strategy for years. As long as you’re still relatively healthy, changing your strategy will be the permanent fix you need when it comes to this not-so-fun area of your financial plan. Peter Dunn, Special to USA TODAY There are many benefits of working with an independent insurance agent. The most obvious one is the ability of an independent agent to shop multiple companies for the best coverage, discounts and price for you, the customer. This does not lock the customer in to just one company and their unique product lines.

As a former owner of a captive insurance agency, I can tell many stories of frustrated customers calling me to discuss why their rates went up due to no fault of their own. I had no options to give them except to modify their polices in an effort to save them the money their policy was going up. This was not a viable option due to the fact it would lessen their coverage on their home or autos and leave them exposed to liability. On those occasions, I apologized for having my hands tied and would recommend another agent I trusted to offer them a quote with the same coverages. As an independent agency, Reliable Insurance Group has the ability to continually monitor your insurance needs, quote those needs in the marketplace and find the best coverage and price to meet your needs. Now, if your rates go up, we simply provide a new quote with over 20 companies we work closely with to test the market and find the best rates while still protecting you and your family. If you would like a FREE insurance review to assess your current and future needs, click on the link below to set an appointment. bit.ly/RiderCalendar  Welcome to our new insurance agency blog! This is our very first post. We're not quite sure what we're going to write about here, but the plan is to create helpful content for customers and prospective clients about information that is relevant to you. We hope you'll come to view this as a top resource for keeping your family and your finances safe. Here are a few of the topics we may be writing about:

Stay Tuned! |

Contact Us

(270) 279-8467 Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed